Mega-trends

Investing in the growth story of the future

Mega-trends shape the world we live in. They influence investment decisions and drive change in the way businesses are being run.

From 5G technology and cyber security to green energy, geopolitical shifts and the digital universe, these are trends that will shape the future of the world we live in.

Thematic funds allow investors to partake in shaping these stories while benefitting from their growth, but not all thematic funds are equal, requiring investors to take great care in their due diligence of the products.

"A mega-trend is an interesting story of human progress, usually driven by the advancement of technology that is expected to unfold over a period of typically 10 or more years," says Christopher Gannatti, global head of research at WisdomTree.

"The benefit of believing in the story is that it could make it easier for investors to hold the strategies over a longer period, and historically one of the best things investors can do is limit trading expenses and stick with strategies they believe in over a market cycle."

So what are the opportunities for advisers and what risks must they look out for?

This scrollable, in partnership with WisdomTree, contains a 30 minute CPD on ESG fund selection, plus links to 7 more CPDs covering the wider topic of mega-trends.

Investing in thematics

Tangible stories that attract investors

The thematic funds market has grown fast in recent years both in assets under management and the number of exchange-traded funds available.

"What started life as a simple investment product designed to track the performance of a plain 'vanilla' index such as the FTSE 100 or S&P 500 has now ballooned into more than 7,000 products, covering a wide range of options and flavours," says Chris Baynes, ETF specialist at Raymond James Investment Services.

The thematic investment approach seeks to identify long-term structural trends that can drive growth in our changing world. Thematic ETFs allow investors to invest in specific industries rather than just sectors, factors or geographies.

They can be a good way to express convictions without having to rely on successful stock-picking or finding active managers that are capable of delivering consistent success.

"The primary reason to consider thematic investing is that clients believe in it and desire to invest in that way," says WisdomTree's Gannatti.

"Thematic investing could have a place within a broader portfolio and asset allocation, which may very well include other strategies. It is clear that many investors believe they need to diverge from solely holding the total equity market portfolio, and this is one way to do just that."

Besides, investors love tangible stories, says Emma Wall, head of investment analysis & research at Hargreaves Lansdown. "Owning what you know has always appealed – look at the privatisation of former public sector industries in the UK in the 80s, and the take up of more recent flotations such a Royal Mail."

The primary reason to consider thematic investing is that clients believe in it and desire to invest in that way

Elliott Frost, investment manager at Lumin Wealth, says adding thematic funds shows clients advisers are thinking actively, while providing reassurance that their portfolios are not overly concentrated.

He says combined with a lower cost core, thematic ETFs used as satellite holdings add higher risk, but they can bring higher reward opportunities too.

Morningstar says thematic assets have tripled since 2018 and now represent 3 per cent of all assets in equity funds globally, but their often higher fees have scuppered long-term performance.

Although more than a half of the thematic funds in Morningstar's global universe survived and outperformed the Morningstar Global Markets Index over three years to the end of 2021, their success rate dropped to just one in 10 over a 15-year period.

Of the funds available to investors 15 years ago three-fourths have since closed. Morningstar stated: "Thematic funds' lacklustre long-term performance can be partly explained by the fact that their fees tend to be higher than those of their non-thematic counterparts."

Thematic funds are not immune to bubbles and concentration risk either. There are a number of things to look out for when selecting a thematic ETF, as Kenneth Lamont, senior research analyst at Morningstar, puts it: "One of the most important things investors mulling an allocation to these funds need to understand is that they are making a bet; to borrow an example from the racetrack, they are making a trifecta bet, or a three-way bet.

"Specifically, investors are betting that they can get three things right:

- They are picking the right theme.

- They are picking the right fund to track the right theme.

- They are picking the right fund to track the right theme at the right time."

Read and bank 30 minutes of CPD on what advisers need to know about thematic ETFs here, and 30 minutes of CPD on how to manage risk in thematic ETFs here.

(Joanne Francis/Unsplash)

(Joanne Francis/Unsplash)

(Andres Siimon/Unsplash

(Andres Siimon/Unsplash

Green energy

A permanent switch to cleaner living

The collective drive towards net-zero emissions by retail investors and institutions alike is already fundamentally affecting the way that energy is produced and consumed globally, says Richard Lum, managing partner and co-chief investment officer at Victory Hill Capital Advisors.

According to the UN, more than 70 countries have set net-zero targets, covering nearly 76 per cent of global emissions, over the coming decades. And as nearly all countries have joined the Paris Agreement on climate change, which calls for global temperature rises to be kept below 1.5C above pre-industrial era levels, there is an apparent collective push to achieve carbon neutrality as part of the shift to green energy. As such, Lum expects to see investors increasingly prioritise opportunities that support these climate goals.

Russian war accelerates switch to green energy

The war in Ukraine has accelerated the need to replace fossil fuels with green energy, writes FTAdviser's deputy features editor Ima Jackson-Obot. Until Russia invaded Ukraine, dependency on oil and gas was viewed through the prism of climate change action. The switch to renewables was primarily about reducing carbon dioxide emissions rather than national energy security.

But since the beginning of the invasion, oil and gas dependency has primarily been viewed as an issue of national security and also living costs. Not only is Russian oil and gas now undesirable because of Russia’s actions in Ukraine, it is also undesirable because of the cost implications for households.

Innovation in bespoke ESG

What's more, as more people buy into ESG investing, the need for more bespoke options has arisen, even for passive investors.

Bespoke is not a term often associated with passive investing but "the industry has evolved", says Lidia Treiber, director of ESG research at WisdomTree.

"What we've seen is a lot of different types of customisation that have been done to provide different ESG exposures for clients, depending on what their value and ESG goals are," she says.

Passive funds can be customised in three ways, Treiber says: negative screening, whereby issuers are removed from an index based on certain criteria; positive screening, where the weight of the index would deviate according to companies with higher ESG scores; and thematic ETFs, which provide highly focused exposures, allowing clients to focus on particular niche areas.

(Pixabay)

(Pixabay)

(Carmen Reichman)

(Carmen Reichman)

New economy real estate

The infrastructure behind the world of the future

The switch to green energy, cloud computing, artificial intelligence and online retail are all big topics that people might already be familiar with, says Christopher Gannatti, global head of research at Wisdom Tree, "and each one of them, if you go under the hood, requires real estate for successful operation".

From cell towers to data centres, the bigger the tech, the more infrastructure is needed. The same goes for e-commerce and our green transformation, which requires everything from solar technology to e-car charging stations.

"We love the potential advancements in battery technology. Grid scale storage allows for greater adoption of wind and solar power. Better vehicle batteries allow for greater electric vehicle adoption. It is even possible that breakthrough technologies allow batteries to power either larger vehicles; trucks, or even certain types of airplanes," says Gannatti.

When it comes to buildings, energy efficiency pays, according to a 2018 Science for Policy report from the European Commission, which described a premium of 3 to 8 per cent in the price of residential assets with green features such as solar panels, low-flow water faucets, energy-efficient lighting, and automation, and an increase of 3 to 5 per cent in residential rents compared to similar properties which were not energy efficient. For commercial buildings the premium was 10 per cent on sales and 2 to 5 per cent on rents.

But as with other thematic opportunities, new economy real estate funds require proper due diligence from investors, says Ben Johnson, director of global ETF research at Morningstar.

"The majority of [thematic funds] over a long period of time are closed, ultimately liquidated, and a tiny minority of them manage to both live across multiple market cycles and actually deliver performance that is better than what one would get from simply owning a broadly diversified tracker fund," he says.

Gannatti says: "We believe that due diligence is a requirement on any fund. One cannot say that all funds tracking the FTSE 100 index are identical either. At WisdomTree, we have done a lot of work to create a thematic taxonomy to help people better understand the available tools across ETFs and actively managed funds. As is the case in any category, there are great strategies and there are below average strategies."

Read and bank 30 minutes of CPD on whether advisers can benefit from new economy real estate here.

(Carmen Reichman)

(Carmen Reichman)

(Dreamstime)

(Dreamstime)

Geopolitical and demographic shifts

The world is changing

The war in Ukraine has led to a spike in the Geopolitical Risk Index not seen since 9/11, but while some investors are responding to the long-lasting shifts, others are warning against getting whiplashed, as "geopolitical shocks can work both ways".

The Geopolitical Risk Index counts the occurrence of words related to geopolitical tensions in leading international newspapers and reports. This benchmark gives a historic perspective on geopolitical risk dating back to 1899 and has so far spiked around two important wars, the beginning of the Koran War in 1950 and during the Cuban missile crisis in 1962, as well as after the 9/11 attacks.

"And now this is another very important time... we've seen this index now stand at a two-decade high, close to levels just reached prior to the 9/11 peak," says Aneeka Gupta, director of macroeconomic research at WisdomTree.

She says there have been two main shifts, the one from decades worth of saving to increased spending on defence, and the decline in the rate of globalisation. In response, she says, clients are re-thinking where to deploy their capital, mainly moving away from the old Faang to the new Faang, which sit across commodities and different assets, such as fuel, aerospace, agriculture, nuclear and defence.

But William Morris, head of investments at Weatherbys Private Bank, warns against second-guessing the geopolitical twists and turns over the coming years. "I'm extremely wary of forecasting what might happen over the coming years or even decades and certainly not upending a portfolio to try and take advantage of that," he says.

"Geopolitical shocks can work both ways and you can end up getting whiplashed."

China

The crisis triggered by the war in Ukraine has seen China’s renminbi viewed as a safe-haven currency. This is the first time this has happened and is a potential game changer, says Gerard Lyons, chief economic strategist at Netwealth.

"It fits with the desire to internationalise the renminbi, although opening up fully the capital account still is some way off," he says. "If the renminbi is seen as a store of value – underpinned by its central bank keeping inflation in check – then this will reinforce its attraction as a medium of exchange. We may also be in the early stages of the great decoupling," he adds.

Changing demographics

Meanwhile there are ongoing and irreversible changes in the global demographic, particularly the female population, and these are having an effect on investment markets, says Annabelle Williams, personal finance specialist at Nutmeg.

As the female population are becoming more active workforce participants, this can affect how markets are performing.

Bank your 30 minutes of CPD on how China's decisions today shape the world of tomorrow here.

(Anton Novoderezhkin/AP)

(Anton Novoderezhkin/AP)

(Reuters/Thomas White)

(Reuters/Thomas White)

(Tolga Akmen)

(Tolga Akmen)

Crypto investing

Is here to stay

Crypto investing is here to stay, says Jason Guthrie, head of digital assets at Wisdom Tree. He says it is an established asset class and will enter the mainstream and that investors will increasingly chose service providers based on their ability to gain access to the digital assets market.

Research from Bloomberg Intelligence found cryptoassets could surpass $120bn (£91bn) within the next six years and enter the mainstream, provided regulation is made clearer. Its Crypto Outlook report analysed the global crypto sector and the trends driving its growth and evolution.

It predicted regulatory approval could allow for the launch of a spot bitcoin ETF by the end of 2023, which in turn would spark "tens of billions in assets added to crypto funds" as regulation becomes clearer in this space.

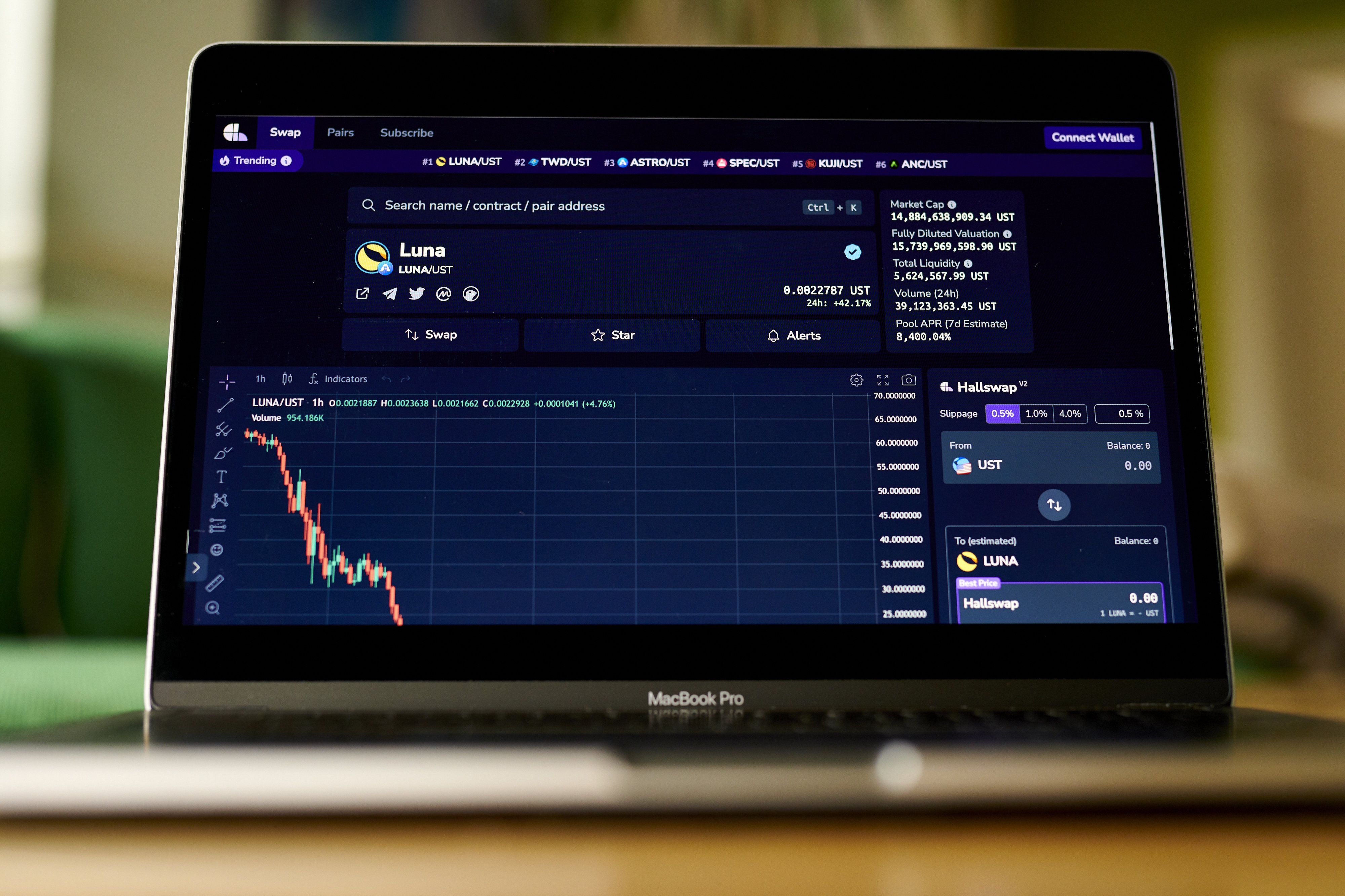

Yet crypto markets suffered one of their most painful and devastating chapters in early May as the Terra ecosystem collapsed, and with it the tokens Luna and UST.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, says: "Fears about rampant inflation and the abrupt ending of the era of cheap money have sent cryptocurrencies careering down a cliff edge, as investors scuttle away from risky assets."

She adds the losses amid rising prices showed that bitcoin was no inflation hedge and inherently risky in nature.

Richard Smith, founder and chief executive of risk analytics platform RiskSmith, says all cryptoassets were affected by the latest downturn. But he says a few of them are likely to recover: "It is a long-term decline for the vast majority of crypto ventures. Most cryptos are valued on nothing but memes. This is the analog of the dot-com bust for crypto. Most of them will end up on the ash heap of history [but] a few will rise from the ashes."

He also points out that bitcoin has risen 30 times over the past five years, which means it is still up several multiples on what it was then.

Christopher Gannatti, global head of research at WisdomTree, says: "Last year, the performance of crypto couldn’t be hotter; in 2022, the performance of crypto couldn’t be colder. However, more people are learning about the use cases and adopting different coins.

"There is immense value potential in this space, but market participants are learning more about how to assess it each day. It is difficult to place the performance of an asset class that is only about 15-years-old in proper context, since many of our more familiar asset classes have existed for 10s or even 100s of years."

Experts agree the crypto space is not what it used to be and has come of age, attracting more professionally minded investors and even the attention of governments, such as the UK's.

Bank 40 minutess of CPD on whether advisers can afford to ignore crypto here, and bank 30 minutes of CPD on how advisers can benefit from the metaverse here.

Carmen Reichman is multi-media editor at FTAdviser

(AP Photo/Kin Cheung)

(AP Photo/Kin Cheung)

The collapse of the Terra ecosystem, and the tokens Luna and UST, will go down as one of the most painful and devastating chapters in crypto history. (Gabby Jones/Bloomberg)

The collapse of the Terra ecosystem, and the tokens Luna and UST, will go down as one of the most painful and devastating chapters in crypto history. (Gabby Jones/Bloomberg)

A series of NFT artworks are displayed on screens in the windows of The Flannels Group department store on Oxford Street, London. (Luke MacGregor/Bloomberg)

A series of NFT artworks are displayed on screens in the windows of The Flannels Group department store on Oxford Street, London. (Luke MacGregor/Bloomberg)

Are names, labels and ratings enough when it comes to ESG selection?

The number of environmental, social and governance or sustainability focused ETFs has grown dramatically in the past two years, making it difficult to chose the right one. But there is a way.

In 2019, only 10 per cent of flows into European ETFs were into funds with ESG or sustainability characteristics, but by 2021 that percentage had grown to more than 50 per cent – a dramatic change. The number of ESG-focused ETFs has also more than doubled, according to Morningstar, with more than 900 available globally in early 2022 compared to around 370 at the end of 2019.

Choice is good, especially in a market where investors have a range of values and priorities. However, we’re then presented with the challenge of how to choose.

Fund names are not always helpful. Even once you have decoded them, acronyms like ESG or SRI do not tell you much and do not always mean the same thing from one ETF to another. Terms like 'responsible' and 'sustainable' are equally hard to pin down. Across Europe, there are also multiple fund labelling schemes with different criteria.

The good news is that things are changing. Regulators in the UK and the EU are working hard to provide greater clarity about what counts as a sustainable investment and what information funds should provide to back up their sustainability claims.

However, these regulations, including the EU's Sustainable Finance Disclosure Regulations and the UK’s upcoming Sustainable Disclosure Requirements, are inevitably complex. It will take time for them to bed in and become genuinely useful to investors.

In the meantime, here are a few things to bear in mind when evaluating and selecting sustainable ETFs.

Transparency and sustainability go hand in hand

By their nature, ETFs are transparent. As they are predominately passive, advisers and investors can easily view not just the holdings but also the set of rules that drive their selection (ie the index methodology).

While active funds may have very well-defined investment policies, the rules-based approach of most ETFs is far more precise. For example, the fund might use ESG ratings, greenhouse gas emissions or screens for certain business activities. The index rules will specify where this data comes from, how it is used to select and/or weight securities, and how often data and holdings are refreshed.

For example, the index might include only companies with an MSCI ESG rating of A or better, or it might exclude companies deriving more than 5 per cent of revenues from fossil fuels. Constituents could be weighted by market capitalisation, or perhaps 'tilted' using a combination of marketing capitalisation and ESG ratings.

The index rules will also detail how often ESG data and holdings are refreshed. With sustainable and ESG funds, there are many possible approaches, using different data providers and different methodologies. In a passive fund following strict index rules, you know exactly what is going on.

While index methodologies can be unwieldy, they are also useful to gauge if an ETF meets a clients’ sustainable investment objectives.

Avoiding nasty surprises

No one likes finding a rotten apple in their fruit bowl. In investment terms, this equates to finding a company in your portfolio that does not match your values.

We frequently see headlines expressing surprise that a so-called ESG or sustainable fund could include, for example, a fossil fuel company. Given the range of approaches to sustainable investing, it is likely that some funds will include companies that others will exclude, and vice versa.

For example, some funds might be focused on active engagement with fossil fuel companies to drive change, while others prefer to exclude them completely.

The problem is not so much the different approaches, both could have value and one might be more effective than the other for certain asset classes, fund types and sectors. The problem is more the surprise when certain companies are included or excluded because the details of the approach were not clear.

The same goes for wider indices. This month Tesla was removed from the S&P 500 ESG index, while oil companies like Exxon are still in there. This might come as a shock for some, but it is quite clear why Tesla was excluded according to others – it doesn’t have a low carbon strategy and has questionable labour practices. These give it a lower ESG score and are fairly standard measures in the world of ESG screening.

"It should be noted that Tesla hasn’t gotten 'worse' from an ESG perspective, according to S&P Dow Jones indices, it’s that everyone else is getting better. So, Tesla has fallen out the index due to its relative ESG score," says Hector McNeil, co-chief executive and founder of HANetf.

"If Tesla improves on these fronts perhaps it will be re-added. We should expect companies to come in and out of ESG indices as each company makes progress at different pace."

But because ETFs typically follow precise rules, you can check that a fund is applying the screens you care about. These could include broad exclusions like violation of the UN Global Compact (a set of principles covering human rights, labour, the environment and anti-corruption), controversial weapons or thermal coal.

However, it could also include a longer list such as alcohol, gambling, pornography and specific religious exclusions. But be sure to check the small print (ie the detailed index rules) because there are different ways to measure these things. For example, one fund might exclude companies with any involvement in thermal coal, while another might exclude only those with more than 5 per cent of revenues derived from thermal coal.

Also be aware that there can be a degree of subjectivity, particularly when it comes to timing. For example, most ESG data providers gave Volkswagen a red flag following their emissions fraud in 2015. However, there was significant variation in when the company was deemed to have taken sufficient action to resolve the issue and the red flag was removed.

All investors can align with Paris climate goals

Climate change is the overarching issue of our time, but there is a perception that investors can only contribute via specialist climate funds, such as clean energy or green bonds ETFs.

It is important to channel assets into these funds to help fund the solutions and technologies we need to address climate change. However, because of their narrow focus, these funds may have concentrated portfolios and could potentially have high volatility. For most investors, they make sense as smaller, satellite allocations rather than core holdings.

The reality is that the majority of client assets are in core allocations and cannot be exposed to excessive risk. Does that mean that these funds cannot contribute in some way to solving the climate crisis? Could these large pools of assets at least be channelled into more 'climate-friendly' investments, while still meeting the requirements for core holdings?

A relatively new solution has emerged in the form of the EU climate benchmarks, a set of rules designed to help investors reallocate capital towards a low carbon economy and align portfolios with the Paris climate goals of limiting global warming to 2C and preferably 1.5C.

The EU has defined two types of benchmark:

- Paris-aligned benchmarks (PAB) must reduce greenhouse gas emissions by 50 per cent compared to the broader market and by 7 per cent each year. They also exclude companies deriving a certain percentage of revenues from fossils fuels and energy-intensive electricity generation.

- Climate transition benchmarks (CTB) must reduce greenhouse gas emissions by 30 per cent compared to the broader market and by 7 per cent each year.

Both benchmarks also apply important ESG screens, excluding issuers violating social norms like the UN Global Conflict, causing significant environmental harm or involved with controversial weapons or tobacco. In essence, PABs can be seen as investing in the economy of tomorrow, while CTBs reflect an economy in transition.

'Low carbon' ETFs are not new. However, the PAB and CTB rules ensure a consistent minimum standard and alignment with the Paris goals. Importantly, they can be applied to almost any asset class and allow broad exposure, suitable for core allocations. For example, Tabula has launched Paris-aligned ETFs covering both the Euro Investment Grade and the Euro High Yield bond markets, both providing well-diversified exposure.

Performance can be a red herring

The adage that past performance is not a guide to future performance is particularly apt for sustainable investments. Many of the risk, opportunities and impacts that they address are in the future not the past and are long-term rather than short-term.

Much is made of the outperformance of ESG funds, for example in the early stages of the Covid-19 pandemic. However, short-term differences between ESG and non-ESG ETFs are often due to sectoral trends that are not ESG-driven. For example, the collapse in energy stocks in early 2020 was more due to a rapid global slowdown than any sudden repricing of climate risk. So, ETFs that excluded fossil fuel companies did outperform, but perhaps not for an ESG-specific reason.

However, over the longer term, these stocks could suffer if they do not adapt to a low carbon economy. Instead of focusing on short-term performance, the key is to understand an ETF’s risk/reward profile and how it might differ from traditional benchmarks.

Paris-aligned ETFs make an interesting example. Currently, these have lower exposure to carbon-intensive companies and exclude many energy companies because of their fossil fuel exposure. They provide diverse exposure but could differ from traditional tracker funds if particular companies under or outperform. However, in future, if the wider economy adapts and decarbonises, then traditional trackers will evolve to become more similar to Paris-aligned ETFs.

If the wider economy does not adapt, then the two products could diverge further, perhaps exposing traditional tracker funds to a greater degree of climate risk.

Do not leave out half the portfolio

Sustainable and ESG-focused ETFs focused initially on the equity market. However, fixed income is a huge proportion of global assets and the range of ETFs is growing fast.

There is now a selection of Paris-aligned bond ETFs for core allocations, green bond ETFs for more specialist exposure and no reason not to shift bond assets towards the new low carbon economy.

Michael John Lytle is chief exeuctive of Tabula Investment Management

Bank your CPD

Other CPDs:

- What advisers need to know about thematic ETFs

- How to manage risk in thematic ETFs

- How Russia's war has made clean energy a necessity and opportunity

- Can advisers can benefit from new economy real estate?

- How China's decisions today shape the world of tomorrow

- Can advisers can afford to ignore crypto?

- How can advisers benefit from the metaverse?